If you are planning on buying property in Japan, you naturally have some questions. Buying real estate in another country, as a foreigner, is replete with myriad complications and federal regulatory requirements you need to take care of before you can become a property owner.

On this page we are attempting to provide answers to as many frequently asked questions for a foreign real estate property buyer in Japan as we can think of right now, but you may like to bookmark the page in case we go on adding more questions and answers.

目次

1. Is there any restriction on purchasing property in Japan as a foreigner?

No, there is no restriction on foreigners if they want to buy property or real estate in Japan. Your visa status is taken into consideration if you seek a mortgage.

2. Why do different agents approach me with the proposals of the same property?

Most of the real estate companies and agents in Japan use a database called REINS. Since these agents and companies have access to this database, sometimes you find multiple agents and companies promoting the same property. This database is not publicly available.

Q.3. How do I check the actual selling price of a property in Japan?

In most of the cases the real estate agent you are dealing with provides you this information. It doesn’t happen always, but some agents don’t give you the full picture and in that case it is better to look it up yourself.

The best place to check the actual price of a real estate property in Japan is the website of the Ministry of Land, Infrastructure, Transport and Tourism (MLIT). They are constantly publicizing the real estate transaction-price information to maintain and promote transparency in the market.

Q.4. Why is mortgage interest so low in Japan when buying real estate property?

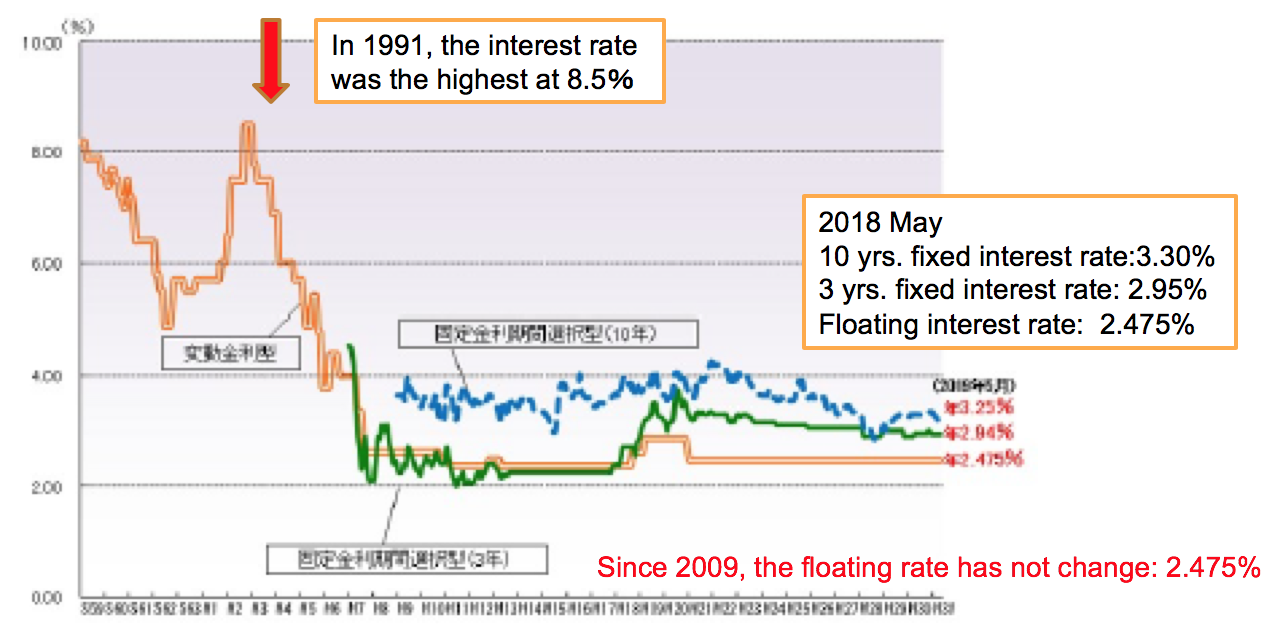

The mortgage interest rates are low because they haven’t been revised since 2009. Refer to the image below.

As the above image shows, although the floating interest rate is 2.475%, in the graph you see the rate as 0.45% or 0.65%

Though the floating rate is 2.475%, which hasn’t changed since 2009, the discount rate, which is called the “Prime Rate” is applied as the actual interest rate and this is why you find the interest rate to be so low in Japan.

Q.5. How much can I borrow from a bank in Japan to buy real estate property as a foreigner?

It varies from person to person. As it happens in every country, how much loan you can get to buy property in Japan as a foreigner depends on your ability to pay back the amount, and hence, you will need to submit your pay slip for the past 3 months (if you are employed).

Alternatively, you can submit your tax certificates. Desirable time period for employment is 3 years, but the minimum time you must be employed to your current job is usually at least 1 year.

Accordingly, how much loan you are eligible to, will be assessed. Additionally, it’s important to bring along property information with you so that the bank can briefly look up the value of the property itself. It helps them assess both your ability to pay the mortgage and value of a property.

Q.6. I’ve got limited knowledge of Japanese, can I still purchase property in Japan?

If you pay cash for the property, an English-speaking agent and solicitor will help through the entire processso that Japanese is not much needed when you want to buy real estate in Japan.

When you are applying for a loan or finance, not all, but some banks require you to speak or write Japanese, and if you can get help from your partner, agent, or an associated professional, some banks allow you to apply but some may not.

If you need to apply for a loan, then you need to consult with your agent to find out a suitable bank for you.

7. How do we know it is a safe property with no stigma attached to it, for example, if it has been a site of crime, death, or any other act of disrepute or psychological affliction?

Want to know the background history of the property you are planning to buy in Japan? Ask you real estate agent or company about the antecedents of the property.

If it is a mansion apartment it must have had, or has a manager responsible for daily cleanup or maintenance. He should be able to give you lots of information. Since he is constantly visiting individual apartments, he’s in a better position to provide you all the titbits compared to the residents and the building management company.

Having said that, there is no clear bound by any Japanese law to provide the prospective real estate buyer any information on whether some unsavory incident happened at the property in the past or if the property has a bad reputation. But it is imperative that you get hold of such information because it has a direct impact on the value of the property.

On https://www.oshimaland.co.jp you can check the antecedents/history of a property such as whether a crime or a death took place at or inside the property.

Q.8. What is Akiya?

An Akiya is an abandoned house that people believe they can buy for “free” orrelatively really cheap.Due to various reasons, some Japanese residents simply abandon their houses and move to newer houses. Some very old people die without an inheritor and consequently, the property is in a state of abandonment. Property owners also abandon their houses because they want to move to places where there are jobs and other career enhancing opportunities.

Also, many empty houses exist because if it is a piece of land with a building, the property tax can be discounted about 1/6. In other words, if you knock out this old house, then the owner of the land needs to pay 6 times more tax in the future.

Are these houses totally free? Nothing is totally free in this world. Even if you can get an Akiya for free you will have to pay property taxes and town residential fee. An abandoned house is often in a state of neglect and disrepair, so you will need to spend money on making it habitable.